BLOG

—

The Reality of CARES Act Funding—How Well is Your Community Doing?

The Coronavirus Aid, Relief and Economic Security (CARES) Act established a $150 billion Coronavirus Relief Fund to help offset the impact of the COVID-19 outbreak on state, local and tribal governments. Most of the Coronavirus Relief Fund money goes directly to states. A population-based formula determines the amount each state receives; however, each state will receive at least $1.25 billion. Local governments with populations exceeding 500,000 will receive additional funds directly. Local governments with smaller populations must apply for funding through their respective states.

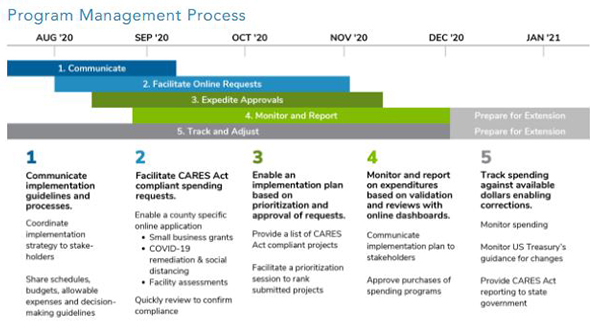

The Woolpert CARES Act Program helps local governments across the country access and manage relief funding. We also provide several CARES Act-approved consulting, architecture, engineering and geospatial services.

This blog series will focus on tips for working smarter and not harder with CARES Act funding, including how to manage the individual programs and samples of services that will help communities survive the COVID-19 pandemic, while following mandated social distancing guidance.

Early numbers from the U.S. Department of the Treasury indicate that over half of the allocated money has not been spent. Is this a case of communities not knowing where to get started? Or are we all still unsure of how to spend these funds?

Whether you are struggling to get started or are carefully trying to navigate through what projects are eligible, here are two key expenditures that should be included in every community’s program:

- Tracking internal expenses (both retroactive and current): This is not a job for a spreadsheet. Tracking expenses specific to COVID-19 is vital for internal accounting, as well as quarterly audits. It is recommended to use a reporting application and dashboard specific to this need. This will decrease the margin of error for data entry and require fewer man hours to fill out and maintain. Most importantly, these applications are an approved CARES Act expense and can be added as an eligible line item in the database.

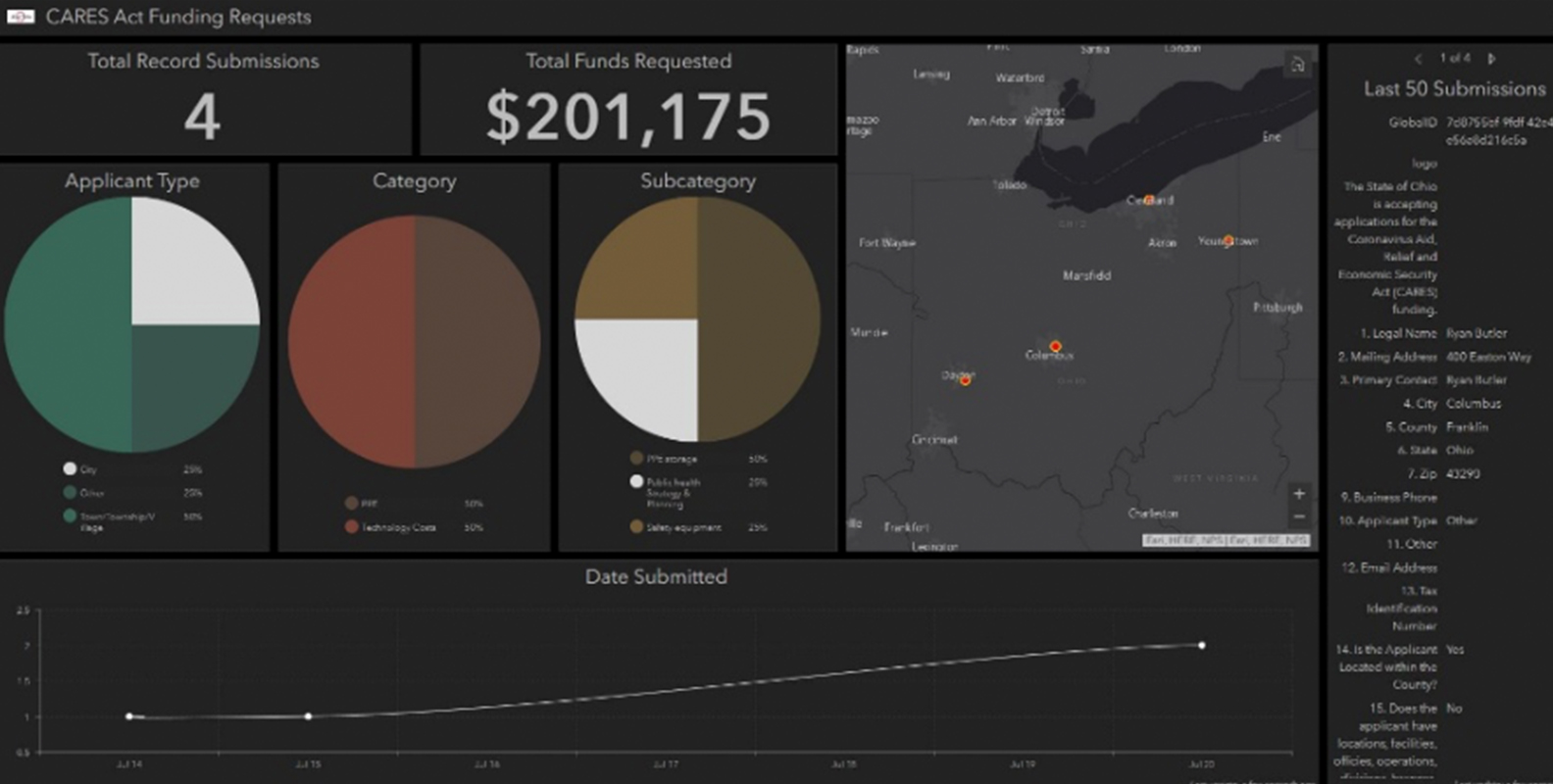

- Tracking the disbursements of funds: As many communities have chosen to disburse small grants to local businesses, it is essential to have an application that can thoroughly track whether the applicant is in your jurisdiction, is eligible for funding, is not applying for multiple grants and so on. This application should provide support and guidance for the completion of necessary forms and have a dashboard (like the sample below) with descriptions, dates, locations, approvals, and the status of applications of the funds that are in the pipeline and have been distributed. As with the internal expense tracking, this is also an eligible expense for CARES Act funding.

With the amount of money at stake, as well as the record-keeping needed to support it, local governments need to be proactive in their use and tracking of CARES Act funds. Applications are inexpensive and provide community managers with support when they need it most.

For more information on Woolpert’s CARES Act Program, visit https://woolpert.com/the-2020-cares-act/.

Jessica Baculik

Woolpert Marketing Manager Jessica Baculik is the team lead for the Woolpert CARES Act Program, while also managing the firm’s geospatial government solutions, innovation and asset management marketing efforts. The proud Penn State graduate recently earned her Certificate in Business Analytics from Harvard Business School and works out of Woolpert’s Dayton headquarters.